Articles

Explore our library for financial tips, budgeting strategies, inspiring community stories, and more!

Rivermark Secures Affordable Housing Grant for Veterans

Rivermark recently secured the maximum $3 million grant from the Federal Home Loan Bank of Des Moines Affordable Housing Program (AHP), designating Portland’s First A.M.E. Zion Church, in partnership with Logos Faith Development, as the recipient.

Spotlight on Rebuilding Together PNW

Rivermark and longtime media partner KGW are showcasing Rebuilding Together PNW as part of the KGW Local Lift series, highlighting great work by local nonprofits making a real difference in communities across Oregon and SW Washington.

Rivermark Invests $150K With Sunshine Division

We’re proud to share that Rivermark is investing $150,000 over three years with our longtime partner Sunshine Division, supporting their annual Thanksgiving Meal Delivery.

Rivermark Partners with KGW Local Lift

Rivermark is proud to partner with KGW as the sponsor of their new Local Lift segment. Together, we’ll spotlight the great work being done by nonprofit organizations in Oregon and SW Washington.

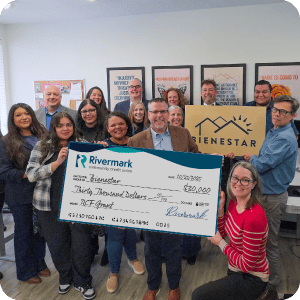

Rivermark Donates $30,000 to Bienestar

The Rivermark Community Fund has awarded its 2025 grant of $30,000 to Bienestar, the Hillsboro-based nonprofit providing safe, stable, and affordable housing for Latinx individuals, immigrants, and families in need across Washington County.

Fraud & Identity Theft: Protect Yourself

News of the latest TransUnion data breach is a great reminder to remain vigilant, protect your personal information, and reduce the risk of fraud or identity theft.

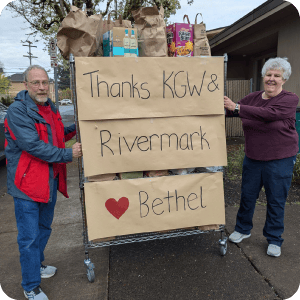

KGW Great Food Drive 2025

The 2025 KGW Great Food Drive has officially wrapped up, and we are proud to share the incredible impact made possible by the unwavering generosity of our community. In partnership with KGW, Toyota, Safeway, Pacific Office Automation, and many other dedicated supporters, Rivermark helped provide over 1.2 million meals...