Articles

Explore our library for financial tips, budgeting strategies, inspiring community stories, and more!

Rivermark Awarded Mental Health Seal

We are proud to announce that Rivermark has been awarded the 2022-23 Platinum Bell Seal for Workplace Mental Health by Mental Health America (MHA). The Bell Seal is a first-of-its-kind workplace mental health certification that recognizes employers who strive to create mentally healthy workplaces for their...

KGW Great Food Drive 2023

The 2023 KGW Great Food Drive has come to a close, and we are proud to share the incredible impact this year’s efforts have had on local families facing food insecurity. Thanks to the overwhelming generosity of our community, Rivermark Credit Union, in partnership with KGW, Toyota, Safeway, Pacific Office...

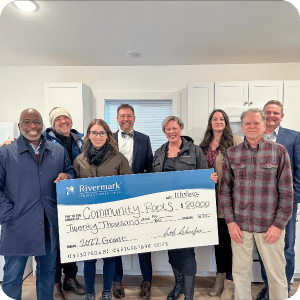

Rivermark Gives $20,000 to Community Roots Collaborative

We are excited to announce that the Rivermark Community Fund, a philanthropic arm of Rivermark Community Credit Union, has directed its 2022 grant of $20,000 to Community Roots Collaborative (C-Roots), a non-profit organization aimed at creating stable and affordable housing. The donation will be used to help...

Helpful College Savings Tips and Tools

As the cost of college tuition continues to rise, it's more important than ever for parents to start saving for their child's education early. But with so many different college savings options out there, it can be hard to know where to start. Here are a few helpful tips and resources to get you on the right...

Fall Home Maintenance

As the weather turns colder, there are a few easy things you can do around the house to stay comfortable, save money, and protect your investment.

2022 Rivermark Golf Tournament Recap

The Rivermark Community Fund hosted its annual golf tournament on Friday, August 19th, 2022. The day was filled with golf, laughter, and charitable giving. We had a fantastic turnout and a wonderful time. More than $65,000 was raised for the Rivermark Community Fund of the Oregon Community Foundation!

Student Loan Best Practices

Student loan debt can be a huge burden for people, both young and young-at-heart. The good news is that there are steps you can take to make the most of your loans and minimize your payments. In this blog post, we will discuss some of the best practices for student loans. We will cover topics such as consolidation,...

10 Banking Terms You Should Know

When it comes to banking, it’s important to understand what’s going on. You’ll want to know all the information available concerning your money in order to make the most well-informed decisions. There are many ways that you can become better educated on the banking process, and perhaps one of the best ways to...