Articles

Explore our library for financial tips, budgeting strategies, inspiring community stories, and more!

Rivermark Donates $3 Million to Rebuilding Together

PORTLAND, OR – The Rivermark Community Fund has directed a grant of $3 million through the support of the Federal Home Loan Bank of Des Moines (FHLB) to Rebuilding Together, a non-profit organization that works to improve the lives of low-income homeowners in the community by providing free home repairs and...

7 Easy Steps to Build an Emergency Fund

Are you prepared for an emergency? If not, you need to start building an emergency fund today. This is money that you save specifically for emergencies. When something unexpected comes up and you need money fast, your emergency fund will be there to help you out. Follow these 7 simple steps and you will be on your way...

30 Day Financial Cleanse

Bad financial habits tend to creep up on us until they compound into big problems. It’s only when we can’t keep up on our debt payments or during an embarrassing situation, that we take notice and decide to do something about it. A financial cleanse is a great way to make lasting changes.

Start a Budget

For a lot of folks, the first step to setting a budget is often the hardest, because you have to stare your ‘bad’ habits right in the face (for example, your daily double-mocha-whipped-yumminess). But once you get a handle on where your money is going, you can set realistic goals for spending (and saving). So, take...

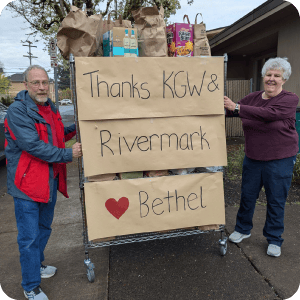

2024 Community Giveback Report

At Rivermark, our dedication to our members extends beyond traditional banking services. We are committed to empowering and uplifting the communities we serve. Our social impact strategy focuses on three fundamental pillars: housing security, children's wellbeing, and combating hunger. We recognize that credit unions...

12 Day Financial Success Advent Calendar

Advent calendars are all about getting little prizes over the course of a few days or weeks with the end goal of celebrating a larger event on the last day. Your financial health should feel exactly like that. Taking small, intentional steps toward your larger goals will help you achieve them faster and feel good...

Community Partnership Spotlight: The Urban League of Portland

As an organization dedicated to promoting social and economic equity, the Urban League of Portland has been an invaluable partner in our mission to create lasting growth and equity in the community. For years, we’ve witnessed firsthand the profound impact this organization has on the lives of individuals and...

Community Partnership Spotlight: Soul District Business Association

Who is the Soul District Business Association? The Soul District Business Association (SDBA), originally founded in 1977 as the North/Northeast Business Association (NNEBA), represents a vibrant and diverse business district in Portland. Their goal is to create multigenerational wealth and ensure that Black...