Welcome to Rivermark!

We're Glad to Have You

Your Auto Loan is Just the Beginning!

You’ve joined Rivermark through your auto loan—and that makes you a member-owner of our financial cooperative. That means you have access to more than just great rates. You have a whole community of support, tools, and services designed to help you thrive financially.

Manage Your Loan

Easy Ways to Make a Payment:

- Online Banking: Log in to Rivermark Online Banking or the Mobile App

- Transfer Funds: From another financial institution

- Send by Mail: Mail your payments each month

- One-Time Debit Card Payment: Available with a small fee

Provide Proof of Vehicle Insurance

You must provide proof of insurance coverage for your vehicle loan within 10 days of taking possession of your vehicle.

Your Rivermark Journey Starts Here

Your auto loan was the first step—but your Rivermark membership opens the door to so much more. Whether you're looking to simplify your everyday banking, grow your savings, or plan for what’s next, we’re here to help you every step of the way. Take a moment to explore your membership benefits and see how Rivermark can support your financial journey.

Rewarding Accounts

Rewards Checking

Say goodbye to big-bank fees. Our checking accounts are always free. As a bonus, if you meet the simple monthly requirements you’ll earn a great rate, plus ATM fee refunds.

- Earn 3.00%1 on balances $0.01 to $10,000

- ATM fee refunds (up to $25 per month)

- No monthly service fee

New Member Savings

When you switch to Rivermark, jump-start your savings with a great rate! A higher rate means your savings will grow faster. Opening a New Member Savings account online in minutes!

Learn More

Certificates of Deposit

If you’re looking to maximize your return on larger balances, lock in a rate of 4.00%3 on our 9 Month Promo CD.

- $500 to open, with no maximum

- Federally insured up to $250,000 by NCUA

Open at your local branch or give us a call.

Learn MoreThe Branch in Your Hand

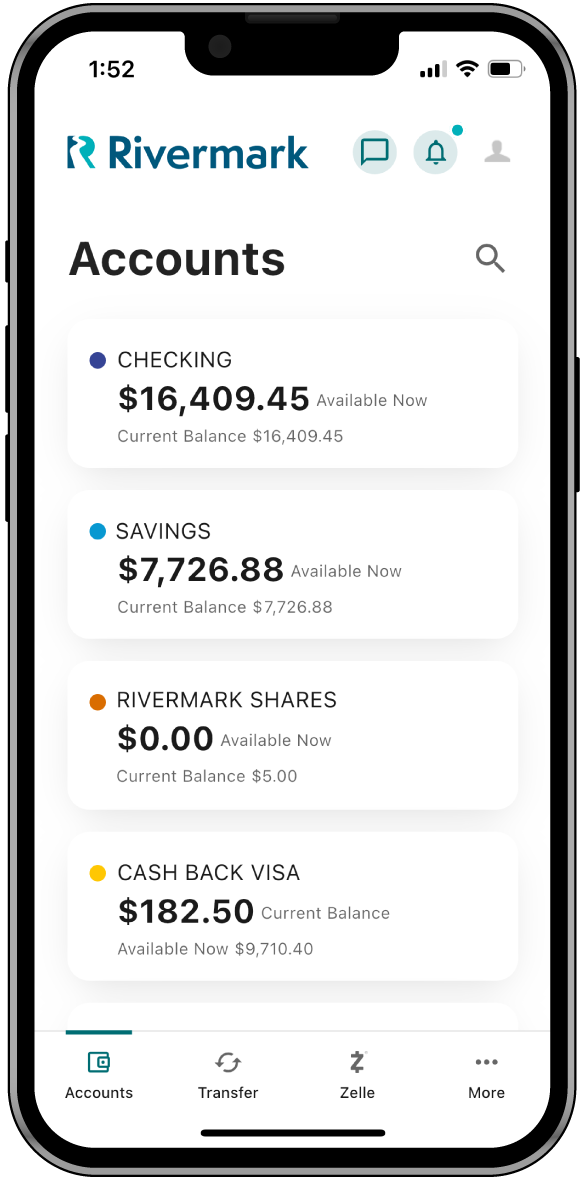

Our cutting-edge mobile banking app puts you in control of your finances, wherever you go!

-

Manage Your Money

Check your balances, transfer funds, pay bills, deposit a check, access your statements, and more.

-

Check Your Rewards

Banking at Rivermark is rewarding! Track your monthly checking rewards status or redeem your credit card Cash Back within the app.

-

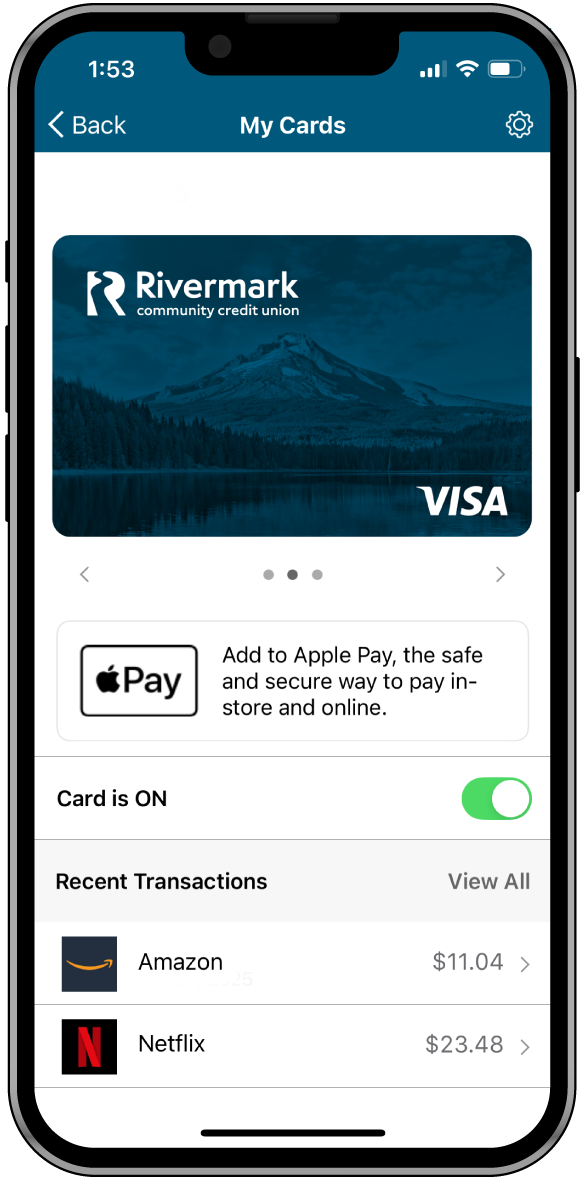

Card Controls

Instant card activations, card on/off, travel notifications, and robust fraud protections. Manage your debit and credit cards from one convenient place.

-

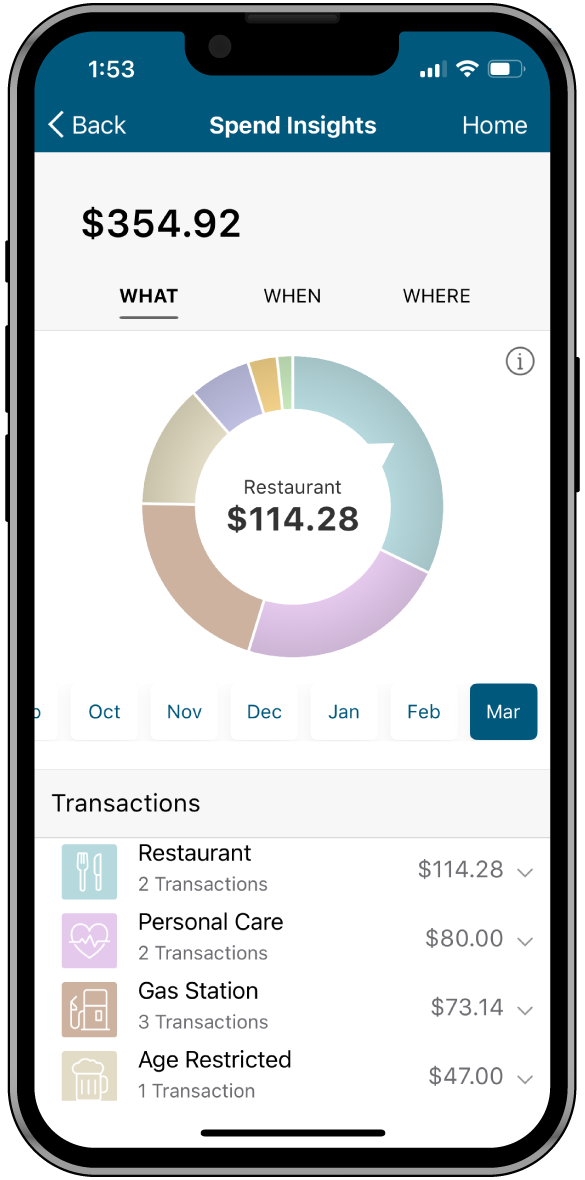

Spending Insights

Explore details about what, when, and where you're spending your money using your debit or credit card.

Rivermark in the Community

Rivermark Branch Locations

We like to make it easy for you to bank with us. And with 19 locations across Oregon and SW Washington it’s easy to find a Rivermark branch nearby. Yep, we’re here for you—wherever you happen to be.

An appointment is recommended for services that cannot be completed via Teller or Video Teller. Schedule an appointment online.

Why Rivermark?

Extended Hours

Top Rated Mobile App

Financial Coaches

Community Focus

Connect With Us

1 APY = Annual Percentage Yield. Rates are subject to change after account opening. Balances of $0.01-$10,000 will earn 3.00% APY, $10,000.01-$25,000 will earn 3.00% to 1.50% APY, $25,000.01 or more will earn 1.50% to 1.10% APY. To earn the Rewards Checking qualified interest APYs associated with each tier and to receive up to $25 of ATM fees and surcharges incurred within the United States refunded, you must meet the following requirements each cycle, which begins one day before the last day of the month: at least 12 debit card transactions posted (not pending or in pre-authorized status) and receive e-Statements. ATM transactions do not count toward the 12 debit transactions. International ATM fees are not eligible for ATM fee refund. Interest and ATM refunds will be paid on the last day of the month in which it is earned. If account requirements are not met, the rate will be 0.05% APY for the entire balance of the account and ATM fees will not be refunded. The blended APY rate range assumes a maximum balance of $35,000. Your APY will decrease as your balance increases.

2APY = Annual Percentage Yield. Minimum balance to open is $5.00. New Member Savings available to new members who meet the minimum requirements for each monthly qualification cycle. Limited to one account per member. To meet the minimum qualification requirements, you must: (1) be a new member to the credit union; 2) open a Rivermark checking account (excludes HSA); and 3) have one direct deposit of $100.00 or greater post to your Rivermark checking account each month. The monthly qualification cycle is defined as the first calendar day of the month through the last calendar day of the month. Account transactions may take one or more business days from the date the transaction was made to post to the account. After your account is opened for 12 months or if you do not meet all of the minimum qualification requirements during any monthly qualification cycle, your account will convert to a Savings account at the prevailing rates. A new member is an individual who has not had an open Rivermark membership in the last 6 months.

3 Annual Percentage Yield (APY); Offer is subject to change without notice. Minimum balance to open and earn APY is $500. Fixed-rate, interest is compounded daily and credited monthly. For Certificate Accounts, there is a penalty for early withdrawal of principal. View all certificate rates.