Make the Switch to Rivermark

Rivermark is a not-for profit financial cooperative, providing affordable financial solutions to its members, with an emphasis on being local, personal, and accessible. We are passionate about financial empowerment and resolving your financial obstacles.

Unlike corporate banks that give their profits to stockholders, Rivermark is a not-for-profit financial co-op. So we pay our profits back to members with a million little things like better rates, lower fees, and more free services.

And every year, all those little things add up to big savings for our members—really big.

If you meet our eligibility requirements, you are welcome to join and we'd love to have you.

Certified Financial Coaches

With our financial coaches -- including bilingual coaches - Rivermark can meet our members where they are on the their financial journey.

Coaches are certified through the Certified Credit Union Financial Counselor (CCUFC) program.

Our coaches are available by appointment at a local branch or remotely.

Rewarding Accounts

Rewards Checking

Say goodbye to big-bank fees. Our checking accounts are always free. As a bonus, if you meet the simple monthly requirements you’ll earn a great rate, plus ATM fee refunds.

- Earn 3.00%1 on balances $0.01 to $10,000

- ATM fee refunds (up to $25 per month)

- No monthly service fee

New Member Savings

When you switch to Rivermark, jump-start your savings with a great rate! A higher rate means your savings will grow faster. Opening a New Member Savings account online in minutes!

Learn More

Certificates of Deposit

If you’re looking to maximize your return on larger balances, lock in a rate of 4.00%3 on our 9 Month Promo CD.

- $500 to open, with no maximum

- Federally insured up to $250,000 by NCUA

Open at your local branch or give us a call.

Learn MoreWhy Rivermark?

Extended Hours

Top Rated Mobile App

Financial Coaches

Community Focus

Who Can Join?

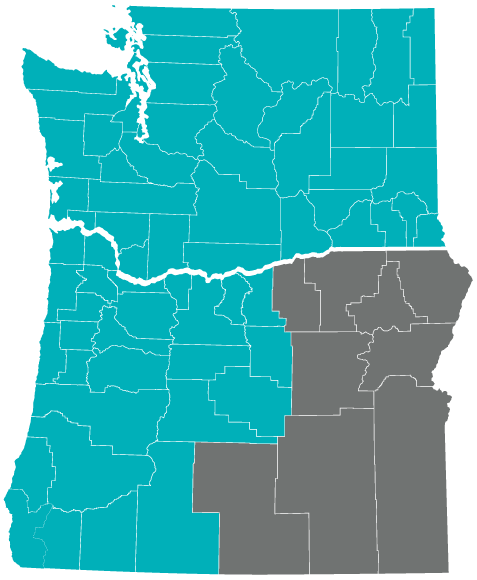

If you live in western Oregon or anywhere in Washington state, you’re ready to be a member. Yep, it’s that easy. In fact, you can join Rivermark if you meet ANY of the three criteria below:

- You live or work in the Portland metro area, or in any of these 24 western Oregon counties: Benton, Clackamas, Clatsop, Columbia, Coos, Crook, Curry, Deschutes, Douglas, Gilliam, Hood River, Jackson, Jefferson, Josephine, Klamath, Lane, Lincoln, Linn, Marion, Multnomah, Polk, Sherman, Tillamook, Wasco, Washington, Wheeler or Yamhill.

- You live, work, worship, or attend school anywhere in the state of Washington.

- You’re related to someone who fits one of the two criteria above. Relatives include spouses, parents, grandparents, children, grandchildren, siblings, aunts, uncles, and cousins. Also included are half-siblings, step-siblings, step-parents, and step-grandparents.

What You'll Need to Join

The first step in becoming a member is opening a Savings Account. Opening a Savings Account requires a $5 minimum deposit and opening a checking account requires a $25 minimum deposit.

By completing our online application, you can open an account in just 10 minutes. Upon receiving your application, one of our representatives will contact you.

You can also open an account at any of our branch locations. Please bring your current Photo ID*, official proof of residency, and Social Security or Tax ID number.

As part of the new membership process, a credit report and a Chex Systems report will be pulled.

When you become a member, you can take advantage of the great rates and services our credit union has to offer.

*Valid photo ID includes one of the following: Driver's License, State Issued ID, US Passport, US Military ID, Resident Alien ID, or Confederated Tribes of OR WA ID Card. For loans, paystubs and tax papers may be needed.

|

IMPORTANT INFORMATION ABOUT OPENING A NEW ACCOUNT To help the government fight the funding of terrorism and money laundering activities, Federal law requires all financial institutions to obtain, verify and record information that identifies each person that opens an account. What this means for you: When you open an account, we will ask for your name, address, date of birth and other information that will allow us to identify you. We may also ask to see your driver’s license or other identifying documents. |

Connect With Us

1 APY = Annual Percentage Yield. Rates are subject to change after account opening. Balances of $0.01-$10,000 will earn 3.00% APY, $10,000.01-$25,000 will earn 3.00% to 1.50% APY, $25,000.01 or more will earn 1.50% to 1.10% APY. To earn the Rewards Checking qualified interest APYs associated with each tier and to receive up to $25 of ATM fees and surcharges incurred within the United States refunded, you must meet the following requirements each cycle, which begins one day before the last day of the month: at least 12 debit card transactions posted (not pending or in pre-authorized status) and receive e-Statements. ATM transactions do not count toward the 12 debit transactions. International ATM fees are not eligible for ATM fee refund. Interest and ATM refunds will be paid on the last day of the month in which it is earned. If account requirements are not met, the rate will be 0.05% APY for the entire balance of the account and ATM fees will not be refunded. The blended APY rate range assumes a maximum balance of $35,000. Your APY will decrease as your balance increases.

2APY = Annual Percentage Yield. Minimum balance to open is $5.00. New Member Savings available to new members who meet the minimum requirements for each monthly qualification cycle. Limited to one account per member. To meet the minimum qualification requirements, you must: (1) be a new member to the credit union; 2) open a Rivermark checking account (excludes HSA); and 3) have one direct deposit of $100.00 or greater post to your Rivermark checking account each month. The monthly qualification cycle is defined as the first calendar day of the month through the last calendar day of the month. Account transactions may take one or more business days from the date the transaction was made to post to the account. After your account is opened for 12 months or if you do not meet all of the minimum qualification requirements during any monthly qualification cycle, your account will convert to a Savings account at the prevailing rates. A new member is an individual who has not had an open Rivermark membership in the last 6 months.

3 Annual Percentage Yield (APY); Offer is subject to change without notice. Minimum balance to open and earn APY is $500. Fixed-rate, interest is compounded daily and credited monthly. For Certificate Accounts, there is a penalty for early withdrawal of principal. View all certificate rates.