Scam Alert: Beware of scam text messages and phone calls pretending to be from Rivermark. Don’t click links or share personal info. Rivermark will not contact you in this manner and ask for login information or account details.

Get to Know Us

We’re Here To Help You Reach Your Financial Goals

Who We Are

We’re Not-for-Profit, so You Save More

We’re not a big bank or a small bank – we’re a better way to bank! Rivermark is a not-for-profit financial cooperative, owned by our members and dedicated to their financial success. Instead of returning earnings to corporate stockholders (like big banks do), we return them to our members in the form of better rates, lower fees, and more free services. Learn about the credit union difference.

Expert Financial Advice – with Lots of Heart

We are dedicated to building trusted relationships with our members. We’re personally invested in helping our members achieve their financial dreams. Whether you are saving for your first car, your first home, or your retirement, Rivermark is here to help you reach your goals.

We Offer Solutions for Every Financial Need

Rivermark is a full service financial institution. From mortgages, credit cards, and personal loans to checking accounts, IRAs, CDs and retirement planning – we offer everything you need to help you reach your goals.

We Help our Community Grow

Banking with us adds value to your community. We donate time and money to help our local communities grow stronger. Learn about our community impact.

-

Rivermark was founded in February 1951 by 140 grocery store employees who formed Safeway Portland Employees Federal Credit Union. In the growth of the credit union, Rivermark has been the acquiring financial institution in thirteen mergers, further expanding its field of membership. Rivermark has also gone through several name changes since its founding—all variations of the Safeway name, until the Rivermark name was selected in 2004 and accompanied the transition of the Credit Union from an employer-based field of membership to a community charter. In 2022, Rivermark was certified as a community development financial institution (CDFI) through the U.S. Treasury—a coveted designation which denotes the organization’s commitment to promoting revitalization and development in low-income communities. Today Rivermark is one of the largest CDFI-certified credit unions in Oregon.

By the third quarter of 2024, Rivermark grew to serve 90,000 members who live or work in an eleven-county span across Oregon and the entire State of Washington. It operated 10 retail branches, held $1.65B in assets, and employed 300 staff.

As a key part of its growth strategy, Rivermark completed its thirteenth, and largest merger to date, on October 1, 2024, completing a rare merger of equals with a fellow like-minded Portland cooperative: Advantis Credit Union. Both credit unions were proudly progressive and held deeply held values around providing financial empowerment and advocacy for their members, supporting, and fostering diversity, equity, and inclusion, and making a difference in their communities. The merger provided the combined Credit Union with the scale and resources to deliver more benefits to its collective 180,000 members and accelerate its work to become the leader in fostering financial wellness within the community.

Advantis Credit Union

Advantis’ story began in 1921 when a group of 12 employees from the Portland Electric Power Company (PEPCO) each chipped in one dollar to make loans to any member of the club who needed a few extra dollars to hold them over until payday. They dubbed themselves “The Down & Outers Club.” The Club was officially upgraded to PEPCO Employees Credit Union in September of 1928—the third credit union chartered in the state of Oregon. Over the next 70+ years, the Credit Union expanded to serve other employer groups within the utility and transportation industry and rebranded itself as Electra Credit Union as a result. The Credit Union experienced several small mergers over the years and then in 2005 it completed a merger of equals with Portland Area Community Employees, or PACE Credit Union, who had been serving city and county employees since 1936. The combined credit union, rebranded as Advantis, grew assets to $466 million and just over 35,000 members. In 2007 Advantis adjusted its charter from employer-based to community-based, which allowed it to operate with fewer barriers to membership.

Just prior to the merger with Rivermark, Advantis served nearly 90,000 members who lived, worked, or worshiped within Oregon’s 24-Westernmost Counties and the entire state of Washington. It operated nine branches, held $1.90B in assets and employed 300 staff.

Who Can Join?

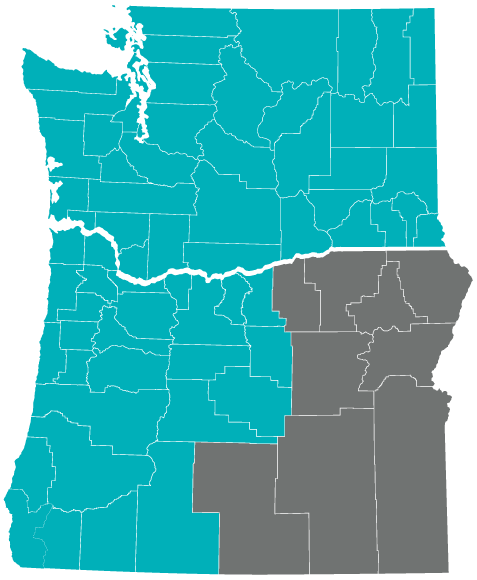

If you live in western Oregon or anywhere in Washington state, you’re ready to be a member. Yep, it’s that easy. In fact, you can join Rivermark if you meet ANY of the three criteria below:

- You live or work in the Portland metro area, or in any of these 24 western Oregon counties: Benton, Clackamas, Clatsop, Columbia, Coos, Crook, Curry, Deschutes, Douglas, Gilliam, Hood River, Jackson, Jefferson, Josephine, Klamath, Lane, Lincoln, Linn, Marion, Multnomah, Polk, Sherman, Tillamook, Wasco, Washington, Wheeler or Yamhill

- You live or work anywhere in the state of Washington

- You’re related to someone who fits one of the two criteria above. Relatives include spouses, parents, grandparents, children, grandchildren, siblings, aunts, uncles, and cousins. Also included are half-siblings, step-siblings, step-parents, and step-grandparents.