2025 Tax Information

Plan Ahead for Tax Filing

Tax Day is April 15, and we’ve put together helpful information to make your tax prep a little easier. See below for timing on relevant year-end statements and documents, along with info on updating your account number(s) to ensure you’re able to receive refunds electronically.

Statements via US Mail

- Printed tax statements will be mailed by January 31, 2026.

- Please allow 7 - 10 business days to receive paper forms.

Electronic Statements

- Electronic tax statements for most account types will be available within Digital Banking by early February.

- If you’re registered for eStatements, we’ll email you when your tax documents are available.

Mortgage Statement Information

- If you’ve paid your mortgage via Midwest Loan Services or Dovenmuehle Mortgage Inc. (DMI), they will mail your tax statement via USPS during the month of January. Note: If you’ve enrolled in eStatements with your servicer, you will not receive a printed statement in the mail.

- Members who had their mortgage transferred from Midwest to DMI during 2025 will receive a Form 1098 from each mortgage servicer.

- To receive a Form 1098, more than $600 in mortgage interest must be paid in a year.

- Statements include interest paid in the prior year, not the interest accrued.

- Additionally, you may retrieve your statement online:

Midwest Loan Services

- Visit midwestloanservices.com.

- Or log into Rivermark Digital Banking and select Midwest Mortgages from the Accounts & Loans drop‑down menu to access the Midwest site.

DMI

- Log into Rivermark Digital Banking as usual.

- Click Pay on your Mortgage Loan; this will open the DMI servicing site where you can download your Form 1098.

Other Statement Information

- For interest-bearing accounts, you will not receive a 1099-INT if you earned less than $10.00 in interest for the year.

- RV loans do not receive a Form 1098 for interest paid, as they are not a mortgage. Please use your December statement for needed year-end information.

- IRA, ESA, and HSA tax forms, including Form 5498, are mailed via USPS no later than January 31, 2025, and will be available in Digital Banking no later than February 28.

- Car loan interest deduction under the One Big Beautiful Bill Act: You may be able to deduct qualified interest paid on your vehicle loan in 2025. Total interest paid on your vehicle loan can be found in Digital Banking in your Auto Loan detail. Visit the IRS website to verify eligibility and qualifications, or consult with a qualified tax professional.

Update Your Direct Deposit Information

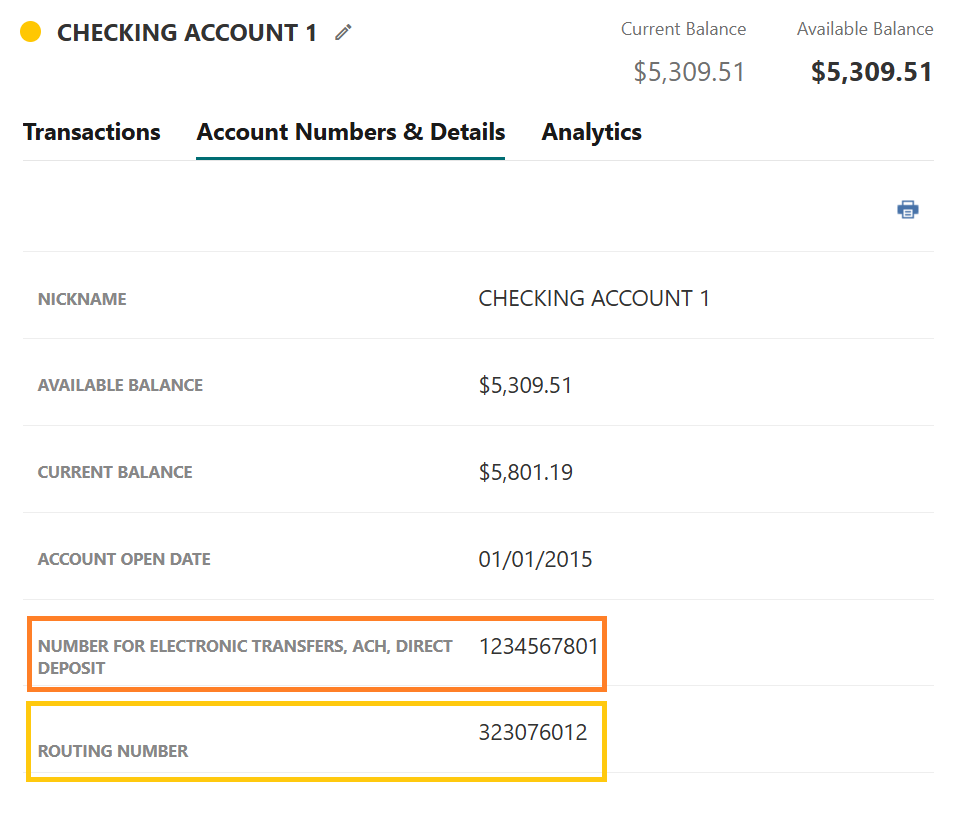

To ensure your refund or payment properly posts to your preferred account as quickly as possible, use the Rivermark routing number (323076012) and your account number. Reminder: Your account number is not your member number.

See below for where to find your account number.

What Numbers Do I Need?

You will need our routing number and your ACH/Account number for Direct Deposit. Rivermark's routing number is 323076012. There are two ways you can find your Rivermark ACH/Account number (see section below).

Option 1. Within Digital Banking

-

Login to Rivermark Digital Banking

-

Click the Checking or Money Market account you'd like your direct deposit to go to

-

Select the Account Details tab

-

Use the number listed for "Number for Electronic Transfers, ACH, Direct Deposit"

-

Note, for your savings account, please use your member number

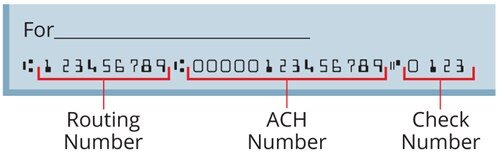

Option 2. On Your Checks

You can also find your ACH number listed on your checks.